Politics & Government

New Hampshire Voters Back Supermajority Requirement To Pass Property Tax Hikes

If you can't stop local spending, can you slow down local tax hikes? A poll says nearly half the state supports the idea. A third doesn't.

If you can’t stop the local spending, can you slow down the local tax hikes?

That’s the idea behind GOP-backed legislation requiring proposals raising local property taxes to pass with a 60 percent “supermajority,” as opposed to a simple “50 percent plus one” majority.

Find out what's happening in Bedfordfor free with the latest updates from Patch.

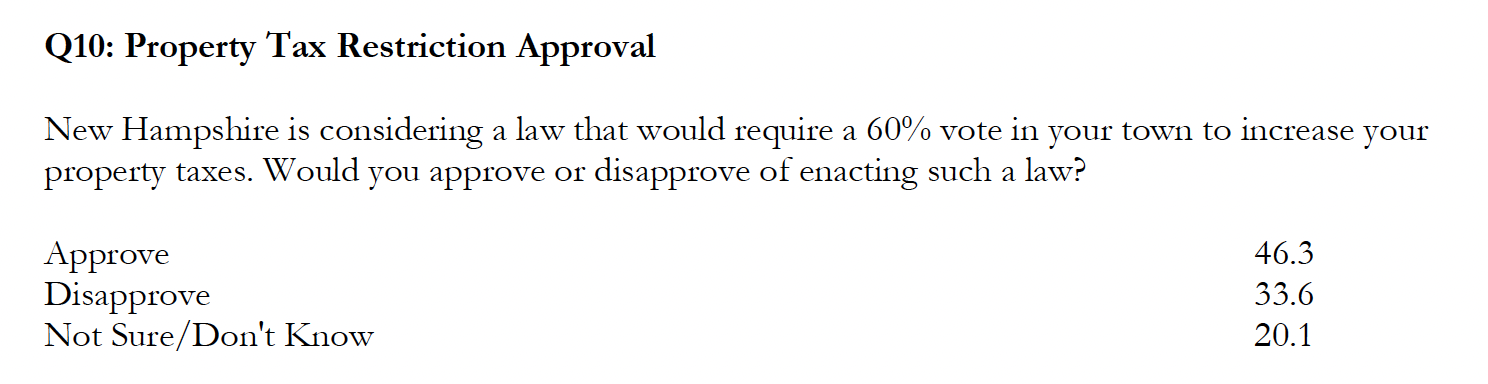

Granite State voters appear to like the idea. In the new NHJournal/Praecones Analytica poll, 46 percent of Granite Staters approved of the supermajority requirement, while just 34 percent opposed it. Another 20 percent weren’t sure or didn’t know.

Find out what's happening in Bedfordfor free with the latest updates from Patch.

Republicans have repeatedly tried to relieve the pressure on property taxpayers by making it harder for local governments to spend money. They’ve largely failed.

At the state level, a bill to impose spending caps on local schools failed to pass the legislature.

At the local level, teachers unions and local progressives have teamed up to block attempts to cap spending in many towns.

For example, when a group of taxpayers in the Kearsarge Regional School District tried to cap spending at $27,000 per pupil earlier this year, activists flooded the district meeting and backed a budget raising the per-pupil spending to $33,000.

The Kearsarge district includes the towns of Bradford, Newbury, New London, Springfield, Sutton, Warner

and Wilmot.

Tax caps aren’t new. Many cities, including Manchester, operate under caps on property tax revenues.

But only six of the state’s 221 towns have tax caps, and the GOP-controlled legislature passed HB200 to address the issue and provide relief.

Under the legislation (HB200), if a proposed appropriation would cause local taxes to exceed the tax cap, voting on that appropriation must be done by ballot. To override the tax cap, a 3/5 (60 percent) majority of voters must approve the appropriation.

Opponents of tax caps in towns, including the New Hampshire Municipal Association, say HB 200 “undermines the voters” and their right to pay more if they choose to. Republicans respond that people are free to pay more if they choose. The problem is when activists force everyone else to pay more, too.

“Mel Thomson was generally right that low taxes are the result of low spending,” said Drew Cline, president of the Josiah Bartlett Center for Public Policy. “But New Hampshire has proven that the inverse is also true. Spending can be suppressed by restraining tax revenues.

“Requiring a supermajority to raise local taxes seems such an obviously New Hampshire thing that a lot of people might be surprised it wasn’t already on the books for decades.”

HB 200 is headed to Gov. Kelly Ayotte’s desk, where she has 60 days from passage to sign it into law.

This story was originally published by the NH Journal, an online news publication dedicated to providing fair, unbiased reporting on, and analysis of, political news of interest to New Hampshire. For more stories from the NH Journal, visit NHJournal.com.